It is completely one’s own decision and own choice as to what app one should use. But we will here provide you an overview of both the app and show what are the services that both these apps provide.

Venmo App vs CASH App

Venmo and Cash apps are pretty much similar. Both are P2P payment applications. Cash and Venmo apps offer numerous features beyond requesting, sending, and receiving money. Both apps offer you debit card facilities. Both apps provide the scope for buying cryptocurrency. However, Cash App is best for investing in the stock market or buying Bitcoin the Venmo app.

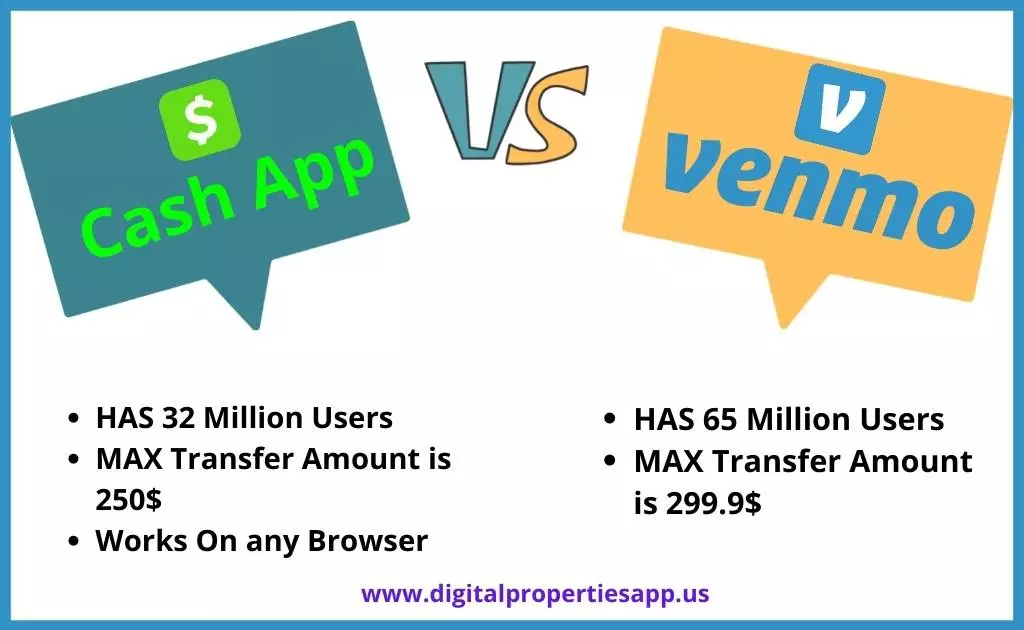

The rivalry between both apps is something that is most talked about. On one hand, the cash app is used by only 32 million people but the app is creating more money. Whereas the Venmo app is used by more people although the usage is less.

Thus both apps have their good and bad features and it all depends on one’s choice.

Despite all these similarities, both applications are dissimilar from each other. Let’s see how:

| Cash App | Venmo | |

| Best for | Making purchases by using a debit cardInvesting in the stock market and buying BitcoinAccepting direct deposit payment | Sending and receiving payment from family and friends Buying crypto |

| Ways to receive | Bank account, ATM, mobile wallet, and debit card | Bank account, check, credit card, ATM |

| Transfer speed | 1 to 3 business days | 3-5 days for free withdrawals |

Venmo vs cash app fees

Venmo app and Cash App are similar, except for some social features. One of the main features of the discrete Venmo App from the Cash App is the fees charged on every payment through both these apps.

If you consider Cash App, you will be charged 0 perper cent sending money through Cash app Balance or linked Bank account. Additionally, you may charge 1.5% for instant transfer via the cash app, and 3% can be deducted from your account balance for sending money through the Cash app credit card.

Now comes the Venmo app. Like Cash App, we will not be charged a single penny on sending or receiving money through credit, debit card, or Venmo balance. However, 1 to 5% or a minimum of $5 can be deducted from your Venmo Balance in case of faster cash. You will be charged 3% as a transfer rate through your Venmo credit card.

Also Check:- How does Venmo work technically?

Venmo vs cash app security

When it comes to focusing on security, it is difficult to say which one is safer Venmo app or Cash App. Cash App and Venmo App- both are used for money transfers. As a result, both the inherently risky. Though, if you are using these apps to send money to your family or friends, you won’t face any issues or scams.

Venmo service vs cash app service

Venmo and Cash App are similar, except for some social features and service facilities. Both app is best for sending and receiving money. But, with Cash App, one can purchase Bitcoin or invest in stocks.

Additionally, the Venmo app offers you digital wallet facilities, and this service is not available in the case of the Cash App.

Coming to transfer speed, in the case of Venmo, it takes three to five business days to complete any transaction. But, with Cash App, you can complete the transaction within one to three business days with standard deposit facilities. The cash app also provides an instant deposit facility, which is absent in the case of the Venmo App.

With the Venmo app, you can get a debit card and credit card facility. You can also add the Venmo app with Google Pay. On the other hand, Cash App provides bank account services and credit card and debit card services. You can add Cash App with Google Pay and Apple Pay.

Also Check:- How to add Venmo Credit Card To Quicken App?

Venmo vs Cash app Number of users

The rivalry between both these applications is something that cannot be ignored at any cost. But also the amount of money both makes and users both have cannot be ignored as well.

More money is made by the cash app having 32 million users and Venmo on the other hand has 65 million users.

Venmo card vs cash app card

First, come to the Cash app card or Cash card. It is a free and customizable debit card that you can connect with your Cash App balance. One can use the Cash App card as a visa card anywhere, in-store or online. It is accepted everywhere. To order your Cash app card:

- Tap to the Cash card tab on your cash app home page

- Click on the option “Get Cash Card.”

- Click on “Continue.”

- Then follow other necessary steps

You must be 18 years and above to apply for the Cash Card. You can link your Cash card with Google Pay or Appel Apple Pay.

Venmo Card or Venmo Credit card is a Visa credit card issued by Synchrony Bank. With Venmo Card, you can avail reward program. Unlike Cash Card, you will be charged on applying for Venmo Card. With a Venmo card, users can get 3% cash back automatically on selected spending with no annual fees. With Venmo Credit Card, users can turn the cash back into crypto and invest that in the stock market.

To get Venmo Card, you have to follow some steps:

- Just open the Venmo app and click on the “Me” button

- Go to Setting Option and click on the “Payment Method”.

Venmo debit card vs cash app debit card

Now Venmo offers Debit Card, which allows its users to carry a physical card with them. Using the Venmo Debit card, you can withdraw money from your Venmo balance, withdraw cash, or add cash to your Venmo balance at ATM.

So, if you use the Venmo app frequently and want instant access to the Venmo fund, then a Venmo debit card will be the best choice.

On the other hand, Cash App offers a physical Cash Card. With the Cash App Cash card, you can buy or sell Bitcoin directly from the app. You can withdraw cash or add money to your account using the Cash App cash card. The Cash card that Cash App offers is the Visa debit card, and the Cash’s banking partners issue this card.

Another important difference between the Venmo Debit Card and Cash App debit Card is:

for Venmo Debit Card, you must have a verified bank account. After issuing the Venmo Debit card, you must link it to the bank account to carry out a monetary transaction with the Venmo app.

On the other hand, the Cash App Debit card does not need to add to your debit card or bank account. With a Cash App debit card, you can carry out a cashing-out transfer of your fund through Cash App Balance.

Also Read: How to Pay Someone On Venmo with Credit card/Bank Account?

Venmo VS Cash App Features Table

| DESCRIPTION | CASH APP | VENMO |

| Description | With the cash app. you can split your bill, also one can pay their friends, append money buy and sell cryptocurrency with the available debit card. | This is a peer–to–peer socially driven payment option which can be used to pay as well as request money from both friends and business. |

| Devices you can use | iOS, Bowser, Android | iOS, Android |

| Customer support | Email, phone | Email, Live chat |

| The way you can pay | Bank account Credit card Debit card Google Pay Apple Pay | Bank account Credit card Debit card |

| The way you can receive | Bank account Debit card Mobile wallet ATM | Bank account Debit card Mobile wallet ATM |

| Transfer time | instantly | Instantly |

| Withdraw time | 3days | 3 days |

| Maximum transfer amount | $250 | $299.9 |

| International transfer | Yes | Yes |

| Bank account required | No | No |

| Fees | Nil | Nil |

Venmo App Features

- ACH payment processing

- Data security and synchronization

- Debit and Credit Card facilities

- Electronic Payment facility

- Customer Engagement

- In-person payment

- Mobile Phone access

- Encryption of data to protect transaction and account information

These all are the everyday features that a money-sharing application used to have. But, Venmo has come up with a new and exciting feature. That is the “Gift-wrap” feature. Your Venmo app has a “Pay Or Request” button, where you can add the recipient’s name. From this button, you can tap the “gift-wrap” icon and select a gift wrap that you want to send along with the payment.

Cash App Features

Through Cash App:

- You can send and receive money

- You can get a debit card and can make a direct deposit

- The investing feature of the Cash App allows you to invest in the stock market ( $1). This is known as “Fractional Shares”- buying a piece of stock.

Now, let’s see some standard features of the Cash App. With this app, you can do the followings:

- Activity tracking

- Electronic payment

- Mobile access

- P2P payment

- Customizable branding

- Purchasing multi-currency

- SSL security

Cash App comes with unique features- “Cash App Taxes”. With this feature, you can file taxes without any charge. This feature has made the Cash App a “one-stop-shop” for monetary services.

What are the disadvantages of using Venmo?

One of the significant drawbacks or disadvantages of using Venmo is:

- You cannot cancel the authorized transaction

- you will be charged 3 percent if you send money through a Credit card.

- Venmo supports no international transactions

- Be aware of the common Venmo scam. One can fraudulently dispute the payment after you send money through Venmo

- Venmo does not insure Venmo, so you cannot get any security over failed transactions via Venmo App or Balance

What are the disadvantages of using the Cash App?

The major disadvantages of using the Cash App are:

- 3% fee is charged on every transaction through Cash App Credit Card

- You can not cancel the authorized transaction

- Transaction rate is limited for the new users

- A fee for instant deposit- Cash App offers free standard cash deposition, and it takes two to three business days to deposit the money to a linked debit card. However, in the case of an instant cash-out deposit, you will charge 1.5% fees with a minimum of 25 cents if you are using Cash App.

Venmo App FAQs

Who owns Venmo App?

Venmo is an America-based mobile payment service that started its business in 2009. The App is originated from the tech world and is used to control consumer-facing money sharing. In 2012, Venmo was owned by PayPal.

Who owns Cash App?

Cash App is a P2P or peer-to-peer payment service. And it is owned by Block, IN., formally known as Square Inc.

Cash App was launched in 2013. and it is the first-ever P2P payment application, which afterward expands its services to direct deposit payment to ACH payment. Even you can buy Bitcoin and cryptocurrency by using Cash App.

Is Venmo better than the cash app?

This statement is such a point that varies from person to person. Also, both the apps have some amazing features which generally vary as per choice. Cash has some best qualities which make it a good and easy app to use but again Venmo also has a few qualities that cannot be ignored.

Thus it depends on all the usage and what the customer is asking from the respective apps and their services.

Is the cash app similar to Venmo?

The cash app is similar to Venmo with just a few additional features and qualities. Both the app has the same purpose and usage. There are just a few differences between the app which is almost negligible.

Thus both the apps provide functions almost similar and same.

Which Is Safe Venmo or Cash App?

Both the apps are safe to use. The user needs to be just a little careful and read all the instructions before using any of these apps.

The instructions are really important because if any fraud or mishap happens the app and customer care will act accordingly. Otherwise, both of these are safe money transfer apps.

Is Venmo the same as Cash App?

You want to go cashless or convenient transfer of money without carrying cash or visiting the bank. You can either use Venmo App or can use Cash App. The Cash app and Venmo App are similar except for some basic features. Both applications offer peer-to-peer money transfer services and seem interchangeable at first glance. But, both app has some unique features and pros and cons.

Which is better to use, Venmo or Cash App?

Venmo might be a better option if you want to use a digital wallet to send money to your loved ones. The user interface is easy to use, transfers are simple, and the social networking feature allows you to keep track of payments. You’ll probably prefer Cash App if you want more features and functionality.

In addition to sending, requesting, and receiving money, Cash App and Venmo have additional features. The two apps support debit cards, and Venmo also has a credit card. Only Cash App offers users who are interested in investing the chance to use its platform to buy stocks.

Is Venmo cheaper than Cash App?

Cash App charges a 1.5 percent fee for instant transfers, there are no fees for sending or receiving payments through the app. On the other hand, Venmo offers free money transfers through bank accounts, debit cards, and direct deposits but levies fees of 1% to 5% for check deposits.

Thank You

Author Profile

-

Raj Singh is a highly experienced digital marketer, SEO consultant, and content writer with over 8 years of experience in the industry.

As a content writer, Raj has a talent for crafting engaging and informative content that resonates with audiences. He has a keen eye for detail and a deep understanding of SEO best practices.

Latest entries

Venmo Debit CardJanuary 2, 2024How to order new Venmo Debit card on the app (2024)?

Venmo Debit CardJanuary 2, 2024How to order new Venmo Debit card on the app (2024)? Venmo TutorialJanuary 1, 2024How to Open Venmo for Nonprofits Account (2024)?

Venmo TutorialJanuary 1, 2024How to Open Venmo for Nonprofits Account (2024)? NewsDecember 27, 2023Game Preview: Texas State vs. Rice – Prediction and Expectations

NewsDecember 27, 2023Game Preview: Texas State vs. Rice – Prediction and Expectations Venmo Credit CardDecember 22, 2023Venmo Credit Card Reviews [2024] Is there any extra charges?

Venmo Credit CardDecember 22, 2023Venmo Credit Card Reviews [2024] Is there any extra charges?